Tax Receipts

Robert Waldmann

The entire blogsphere seems to be fascinated by the idea that maybe the IRS could mail tax payers a receipt showing where their taxes go. Oddly the IRS just decided to stop mailing something — 1040 booklets. Which, you guessed it, explain where your tax money goes.

This has been mailed to every household every year for decades. So why are tax receipts a new idea ?

click to enlarge

footnotes and rant after the jump.

click to enlarge

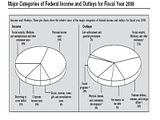

Now it’s not perfect. The IRS doesn’t like tiny slices so they put medicaid and welfare together as “social programs” (welfare might mean tanf plus food stamps plus suplementary security income) and put foreign aid in with defence. People would have to read the footnotes. An actual policy is never as pleasing to people as one they can design but it can be as good as the one which will come out of the sausage factory.

I am old enough to have filled out tax forms on paper. Nothing encourages casual skimming and looking at the illustrations more. I have spent much time staring at these pie charts while trying to force myself to look through my “records.”

No one seems to know about the pie charts (which are still there in the 1040 instructions on page 101 (warning huge boring pdf)).

Like Tim Geithner (see page 170) I am tempted to blame turbotax.

A receipt in the mail will do no good. The only solution is to require tax preparation programs to display the data and tax prepareration firms to show it to people before they sign the forms. Of course forcing people to look at something really is illiberal. Nothing less will force US taxpayers to learn where the money goes. They don’t know, because they don’t want to know.

Actually there should be a citizenship quiz say 100 scantron questions and your vote is multiplied by how many you get right.

Nice joke Troy. Just imagine the questions when the GOP is in office!!!!! LOL

I like Troy’s suggestion, but recognize that it would b e subject to tampering. Who is to determine the correct answer to any question related to taxation and government finance. Who is to decide that it is proper to discuss the issue displayed in the charts as a unified budget, which the charts imply, though the law clearly indicates that the budgets are distinct and linked only by the borrowing of a surplus from one by the other. The pie charts, even with the foot note explanations, are at best misleading. First, it combines the FICA contributions, payroll taxes, with the general tax streams though the two are dedicated by law to fund different aspects of government expenditures. To combine that information is to confound the purpose of the several funding streams. Misleading data/information is worse than no data at all.

The commenter, his name escapes me, who suggested on another thread that taxes and spending were unrelated because the government wasn’t actually spending funds received via taxation has a good point. Given that the deficit is so far above the assumed tax receipts what difference does the allocation of funds in to funds out really make? Maybe better to look at taxes in as just one means of reducing the inflationary trend brought about by government spending that is unrelated to government income. If there’s too much money being distributed into the economy by the government then raise taxes and burn the stuff as it comes in.

Jack,

“If there’s too much money being distributed into the economy by the government then raise taxes and burn the stuff as it comes in.”

That’s standard procedure already. Both the Fed and the treasury have large incinerators where they burn old money, T Bills, T notes and bonds. It’s called monetary policy and redeeming government bonds. Just so I don’t sound like I haven’t been paying attention, this can happen electronically too.

If you want to know why we have an ever increasing national debt, it is because we have greatly separated government spending from taxation. It’s not hard to figure why. It makes government spending painless to the taxpayer-voter. In fact, if you can announce you are invading Iraq and combine it with a tax cut, we will probably take over the world.

Cedric,

Thanks for the reply, but I wan’t actually asking why we have national debt. If the commenter I was referencing is correct, he had a few comments recently on an earlier thread, the debt is irrelevent. Government issues money. The only bottom to the barrel is the likelihood of inflation due to the ever increasing money supply from so much spending. That’s where the taxation comes in, not to reduce the debt, but to reduce the quantity of money. Issue funds via government spending and then reduce the funds in circulation by taxing and burning the receipts.

The discussion has to move awqay from taxation so that the focus can be returned to the appropriate use of government. How much the Bush/Obama Wars of Adventure costs is not the issue. War with no justification is the issue. The cost of health care is not the issue. The delivery of quality health care services to all Americans at a fair price is the issue. This line of reasoning can be extended and applied to all aspects of government activity with the focus on justification and values rather than cost.

Except for one problem, rapidly expanding debt is not irrelevant, and that’s how the fairy tale ends.

Except for one problem, rapidly expanding debt is not irrelevant, and that’s how the fairy tale ends.