Guest Post: Does a lower Corporate Tax burden increase private investment?

Update: Dan here: I am posting Jon’s reply now to comments in this post. Technical troubles continue for Jon.

It is always a pleasure to find clear and concise posts from a ‘new’ econoblogger. Mike Kimel found Econographia. Hopefully more is on the way.

by Jon Hammond

Guest post: Does a lower corporate tax burden increase private investment

The efficacy of taxation in promoting or discouraging economic growth remains a hotbed of disparate perspectives on the part of economists and policymakers alike. Some politicians insist that more incentives for private investors — lower taxes on corporate profits — will lead to faster and better-balanced growth. According to a New York Times/CBS News poll in May 2011, a majority of Americans believe that increased corporate taxes “would discourage American companies from creating jobs.” The assumed mechanism for spurring economic growth and job creation is new private or business investment, incentivized by lowering the corporate tax burden.

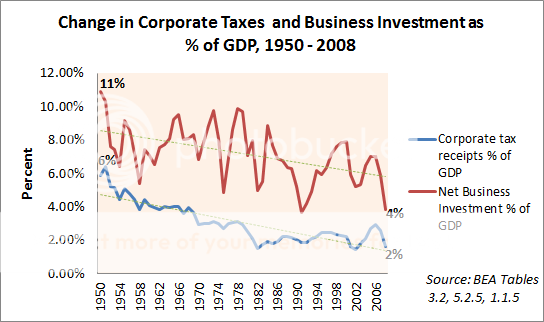

The following graph displays a comparison of net private investment as a percent of GDP against corporate tax receipts as a percent of GDP … for the post-war period 1950 – 2008. The data is sourced from the Department of Commerce, Bureau of Economic Analysis (BEA), as follows:

GDP – NIPA table 1.1.5 here

Corporate tax receipts – NIPA table 3.2 here

Net business investment – NIPA table 5.2.5 here

At this level of analysis, we should expect to see an inverse relationship between the two, specifically: with a decline, over time, in corporate tax receipts as a percent of GDP, there should be an increase in net private investment over the same time period.

Statistically, one would expect these two series to be negatively correlated.

Change in Corporate Taxes and Business Investment, 1950 – 2008:

As the graph shows, both corporate tax receipts and net business investment as a percent of GDP declined over the period 1950 – 2008. The data does not show an inverse relationship between the two series. Rather, the data shows a substantial positive correlation, i.e., high values in the tax series are associated with high values in the private investment series, and the same association is observed for low values. This counters the idea that business investment increases when the tax burden decreases. Moreover, this decline in business investment suggests that by retaining more and more of their earnings, corporations are failing to make economically productive use of their capital .. and shortchanging growth.

Taxes as a percentage of GDP and tax rates are NOT the same thing, and the taxes at an individual investor or company level are not necessarily tied to taxes as a percentageof GDP.

And then there is a shift to pass-thrus.

There are a lot of factors in this relationship, be careful how measurement is done.

I asked Linda to write on pass-thrus as the WSJ wortye on such today.

Minor correction… Jon found me.

Also, STR, the post doesn’t mention tax rates. The problem with the pass throughs is that it makes it hard to determine what is a corporate income and what isn’t… the post makes as light of an assumption possible, in my opinion, given the limitations of the data, particularly since the real income in corporations presumably isn’t in the pass throughs.

“…by retaining more and more of their earnings, corporations are failing to make economically productive use of their capital .. and shortchanging growth.”

I understand the general idea, but I’m not sure that specific statement of the idea stands up to scrutiny. I don’t see how corporations are failing to make use of capital BY retaining earnings. The standard view is that retained earnings are a solid source of investment capital – a predictor of corporate investment. What we have now is corporations retaining earnings and under-investing those earnings, but it is not the decision to retain earnings that leads to low capital spending.There needs to be a further explanation for the break-down of the historic relationship between retained earnings and investment.

Mike’s response to STR is correct. Hammond specifically refers to “tax burden”, which in standard econ parlance means tax revenue as a share of whatever, usually GDP. However, the standard tax argument has to do with marginal rates. Hammond’s observation is correct, but is only an early step in the analysis. Why have corporate revenues fallen? How much of the drop is accounted for through lower marginal rates, how much through loopholes, how much through transfer pricing and other accounting trickery?

Hammond’s point is much like the one that Mike began making here a few years back. It is very hard to find evidence that cutting taxes at current US rates does anything to foster growth. In the absence of any such evidence, we have not reason to fall for policy arguments based on tax cuts leading to growth. But at the same time, we can’t make strong statements about what IS happening based on a gross tax burden relative to gross domestic product comparison. If we had not already seen Mike’s more extensive work, then Hammond would have a lot of work to do to make his argument.

“…by retaining more and more of their earnings, corporations are failing to make economically productive use of their capital .. and shortchanging growth.”

I understand the general idea, but I’m not sure that specific statement of the idea stands up to scrutiny. I don’t see how corporations are failing to make use of capital BY retaining earnings. The standard view is that retained earnings are a solid source of investment capital – a predictor of corporate investment. What we have now is corporations retaining earnings and under-investing those earnings, but it is not the decision to retain earnings that leads to low capital spending.There needs to be a further explanation for the break-down of the historic relationship between retained earnings and investment.

Mike’s response to STR is correct. Hammond specifically refers to “tax burden”, which in standard econ parlance means tax revenue as a share of whatever, usually GDP. However, the standard tax argument has to do with marginal rates. Hammond’s observation is correct, but is only an early step in the analysis. Why have corporate tax revenues fallen? How much of the drop is accounted for through lower marginal rates, how much through loopholes, how much through transfer pricing and other accounting trickery?

Hammond’s point is much like the one that Mike began making here a few years back. It is very hard to find evidence that cutting taxes at current US rates does anything to foster growth. In the absence of any such evidence, we have not reason to fall for policy arguments based on tax cuts leading to growth. But at the same time, we can’t make strong statements about what IS happening based on a gross tax burden relative to gross domestic product comparison. If we had not already seen Mike’s more extensive work, then Hammond would have a lot of work to do to make his argument.

kharris,

One can either take data as far as it will go or make stuff up. I like to think the former is a hallmark here at Angry Bear and Hammond is doing just that. The process is a long slow slog, of course, and sometimes circling around and circling around a few times results in some insights we hadn’t seen before, and every so often, a big insight. As you said, this is a step in the right direction. While I appreciate your kind words, Hammond is actually doing something I haven’t put time and effort into, namely looking at the corporate tax burden.

What he is finding is similar to what I found on the individual tax burden – as you say, the policy arguments that “cut taxes or the sky will fall” or, the converse, “cut taxes and all sorts of good things will happen” have not been borne out in the data. Arguably the effect should be stronger with corporations than with individuals – after all, they exist to make a profit, or so say my econ textbooks. Thus, if anything, according to the standard story we’re perpetually told in the media and by esteemed theorists, Hammond should have been even more likely to spot the effect that I didn’t find… and he didn’t. Its one more (very large flashing neon) sign that says the theory that seems to underpin economic discourse is wrong.

Is it an oversimplifcation to say that if the tax structure provides an incentive to sell the seed corn and pocket the cash that it should not be a surprise that less is planted?

Maye he need to use a chart I have shown here several times and look at the effective tax rate– corporate taxes as a share of corporate taxes. It follows a path very similar to the taxes as a share of GDP, but it is or a rate.

I may have more problem with his using the “net” investment figure. It is something I watch, but

I doubt that it is something firms actually use or even aware of in their decision making process.

If you use nominal investment as a share of GDP it looks fairly flat and “real” investment as a share of real GDP actually shows a rising trend that supports the argument that taxes matter.

When I look at the alternatives I’m left in an uncertain state about the impact of taxes on investment.

This is especially true when I consider the role of venture capital funding the 1990s capital spending boom. It is hard to argue that lower tax rates were not a significant factor in the big expansion of venture

capital in the 1990s. But this has to do with personal tax rates, not the corporate tax rate as corporate taxes did not contribute to the 1990s venture capital expansion.

Not sure how the data on corporations was put together, but at the small business level–you know those “job creators”– the incentive to leave money in the corporation was that the profits would be taxed at a lower rate in the corporation than at individual rates of the owners/managers. With the steady reduction in top individual rates that is no longer the case and the typical small business has zero profit because all of the profits get expensed in salary and benefits for the owners. To some extent this is the same trend in larger corporations where the managers would have taken stock options, deferred compensation etc and now just take as much money as the directors let them take each and every year. The other thing that has happened is that there are alternatives to the corporate form which protect the owners from any concern about double taxation such as LLCs. There were always Subchapter S corps, but the rules were viewed as too restrictive. I suspect that these trends are affecting the data, but the bottom line is that corporate tax rates are not too high–individual tax rates are too low.

“but the bottom line is that corporate tax rates are not too high”

Then why are they lower everywhere else? If high corporate taxes are a good thing, then are there not high corporate taxes everywhere else?

The United States is on the top of the list.

That is the issue with U.S. business trying to outsource its profits. Most corporations do not have that option. The race to the bottom internationally is the same as the race to the bottom that goes on between the states. The issue as I understand it here is does a lower corporate tax mean greater corporate investment? The chart suggests the answer is “no”and I was just pointing out that one reason for that is that money which might stay in the domestic corporation gets siphoned off not because of the corporate tax rate, but because the individual rate is so low.

It is logical if you can get past your preconceived notions. The logic is as follows: if something comes easy, most take it easy. Others have had Michael Jordan and Tom Brady’s talent, few worked as hard as they did to make the most of it…. most accepted a lower level of success as plenty sufficient so as to avoid hard work. Similarly, with money, if making money is made easier, you hit your satisfaction level faster, and many stop producing. With record profits…. what else is there to accomplish? Keep lowering taxes, and you keep making it easier to quit sooner.

We use the above logic for social welfare for the needy – don’t give them money or else they have no incentive to work. If that is true, then obviously the same holds true for the wealthy (at some point they don’t need to work, and start playing golf), and for businesses – especially when the CEO can profit when his company does bad or good.

Finally, when the US lowers its tax rate, it simply encourages other nations to do the same. It becomes a race to the bottom. California and NY have very high taxes but are two of the most productive States (and big cities within) BECAUSE you HAVE TO WORK HARDER to enjoy the good life there. And BECAUSE places like LA, SD and SF in CA and Manhattan in NY are desirable places to live they can get away with charging high taxes than the likes of Delaware and TX. The same is true of the US…. we are a more desirable country than most, and can charge higher tax rates and get away with it.

The conclusions – keep our taxes high (err, get them high again, they are VERY low), which will allow other countries to raise their taxes, and we will once again FORCE people and companies to work harder, and be more productive, in order to retire wealthy.

Instead we’ve done the opposite – financialization has proven counter productive – but that is where the easy money is, and the result is the GFC.

Actually, you can get to Hammond’s point with a few minutes of serious thought.

Taxation provides an incentive to lower the net profit in the current year (and across the amortization period) by spending and investing.

As the tax rate is lowered, that incentive evaporates.

I’m delighted to see the corroborating empirical evidence. But I still have reservations about the concept of net investment.

Cheers!

JzB

Sorry, but no. Hammond mis-specified, and so has no claim to reach a strong conclusion, but he tries to anyway. Rusty had it right on that point. Hammond chose corporate tax revenues as a share of GDP, instead of using marginal rates. That’s a pretty fundamental error,, if you intend to draw a conclusion regarding trends in capital investment. GDP-share arguments make sense if we are talking about equity or about budgetary trends or the like, but not investment. I don’t care that the press and wing-nuts get this wrong. There is no reason Hammond should have found a stronger effect than you did, based on the use of revenue shares. Revenue shares involve too many other variables that have no good reason to affect investment trends.

Yep, this is the way it’s done.

Cleverly argued, well written.

Jon has been trying to comment here without success….hopefully soon. Great discussion.

I do not agree. This assumes that companies behave like the average person. Instead companies are under selective pressure to earn more. Successful start ups sell out to bigger companies if they are content to cash in. Money concentrates in the most ambitious and successful companies which are always looking to increase profits. Investors are looking for high returns, not good-enough returns. There is always someone ready to step in and work hard if there is money to be made.

You suggest that if we raise taxes, investors will simply invest more to make up the difference, but I think the opposite would happen. If companies cannot earn much profit in the US, they will gradually shift investment elsewhere. Also investors can simply stop investing so much. If high taxes reduce the return on investment, there is a real risk that people with extra money will spend it rather than invest – why take the risk of investing to earn more if the earnings are insuffiecient? The result would be less investment and therefore less improvement in productivity. Of course, ordinary people would still have to invest for college and retirement, but somehow I doubt you are as enthusiastic about cutting into their returns.

Result: The richest move their businesses to somewhere more welcoming. The moderately wealthy spend more instead of investing. The middle class has a harder time saving. And the economy stagnates.

Thanks for the replies. Rdan and I have been stymied by the openid login process and it’s steadfast refusal to let me comment … hence this belated response, thanks to Rdan.

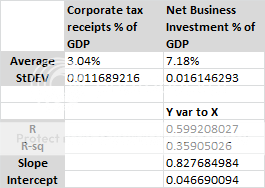

“ … Hammond’s observation is correct, but is only an early step in the analysis”.

Yes .. kharris is correct .. as characterized in paragraph four of the original post. Grappling with these issues is like peeling onions. However, at this level of analysis, what struck me is that the results are completely and rather strongly in the opposite direction than the standard thinking about this relationship. That being the case, a healthy skepticism about this thinking seems warranted given the observed findings. Bear in mind that a literal interpretation of the slope/intercept data shown would say that for every 1% decrease in corporate taxes as a percent of GDP, we can expect a .83 percent decrease in net private investment as a % of GDP.

This analysis isn’t an attempt to model the corporate earnings retention decision-function. However arrived at, the failure to invest in growth, arguably, has intentional underpinnings, and, logically, this includes the decision to retain (vs. invest) earnings and/or make alternative uses of capital as profits are realized … somewhere along the way. Recall the approximately $300 billion in overseas profits that were repatriated by American companies in 2005, when they had to pay a tax rate of just 5.25 percent, rather than the normal corporate tax rate of 35 percent. The amount was five times the normal amount of repatriations. What has happened to all these profits? In this case, about 92 percent went to shareholders, mostly in the form of increased share buybacks and the rest through increased dividends. Barely a trickle went towards new growth (see NBER http://www.nber.org/papers/w15023).

One further comment: while net business investment has atrophied as a percent of GDP, real GDP per capita over this period increased substantially .. by 228% (BEA NIPA 7.1). And the fuel for that growth? Increased consumer spending .. in conjunction with and amplified by government outlays must be considered.

I will address the questions raised about net private investment shortly […]

Jon Hammond replies

Thanks for the replies. Rdan and I have been stymied by the openid login process and it’s steadfast refusal to let me comment … hence this belated response, thanks to Rdan.

“ … Hammond’s observation is correct, but is only an early step in the analysis”.

Yes .. kharris is correct .. as characterized in paragraph four of the original post. Grappling with these issues is like peeling onions. However, at this level of analysis, what struck me is that the results are completely and rather strongly in the opposite direction than the standard thinking about this relationship. That being the case, a healthy skepticism about this thinking seems warranted given the observed findings. Bear in mind that a literal interpretation of the slope/intercept data shown would say that for every 1% decrease in corporate taxes as a percent of GDP, we can expect a .83 percent decrease in net private investment as a % of GDP.

This analysis isn’t an attempt to model the corporate earnings retention decision-function. However arrived at, the failure to invest in growth, arguably, has intentional underpinnings, and, logically, this includes the decision to retain (vs. invest) earnings and/or make alternative uses of capital as profits are realized … somewhere along the way. Recall the approximately $300 billion in overseas profits that were repatriated by American companies in 2005, when they had to pay a tax rate of just 5.25 percent, rather than the normal corporate tax rate of 35 percent. The amount was five times the normal amount of repatriations. What has happened to all these profits? In this case, about 92 percent went to shareholders, mostly in the form of increased share buybacks and the rest through increased dividends. Barely a trickle went towards new growth (see NBER http://www.nber.org/papers/w15023).

One further comment: while net business investment has atrophied as a percent of GDP, real GDP per capita over this period increased substantially .. by 228% (BEA NIPA 7.1). And the fuel for that growth? Increased consumer spending .. in conjunction with and amplified by government outlays must be considered.

I will address the questions raised about net […]

Ages ago, Fortune had an article on US Rubber – yes, that long ago – in which they asked rhetorically how the company could be paying a dividend while it wasn’t earning enough money to cover it. They explained it simply. When you take a loan and don’t make the payments, someone comes to you with a piece of paper and says “pay up”. When you run down your research, development or physical plant, no one comes to you with a brick and says “pay up”. Basically, the US private sector has been liquidating since the early 80s.

The reasons are simple, and not unexpected. If you read your Berle and Means from the early 30s, they argued that low taxes encourage executives and investors to take money out of the company. Higher taxes encourage them to leave the money there where it might be reinvested. Corporate taxes went down in the 80s, and so did investment. Why did anyone ever expect the opposite? Water doesn’t run uphill.

And one should exclude payroll taxes from that calculation.