Social Security: The Elevator Pitch

• Since Social Security started it has always brought in more money than was spent. It contributes a surplus to the total federal budget. That’s true today and will continue for quite some time.

• The extra revenue needed to make SS solid far beyond the foreseeable future (75 years) is tiny: 0.6% of GDP.

• A 0.6% revenue increase would not be a big burden. The U.S. has been taxing about 28% of GDP for decades, compared to 30-50% in other rich countries (average: 40%).

• Coincidentally, Scrapping the Cap on SS contributions — so high earners paid payroll tax above $110K — would deliver … 0.6% of GDP.

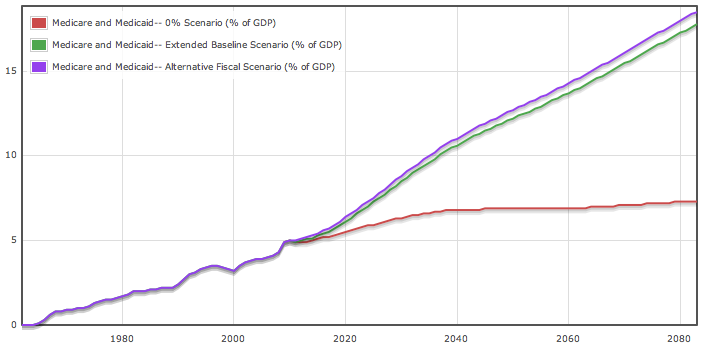

Worried about our fiscal future? It’s the health care costs, stupid. What providers charge.

U.S. providers charge two to five times what they charge in other countries, and it’s rising faster — and faster than wages, GDP, inflation.

If you’re not talking about that, you have nothing useful to say about our fiscal future:

Cross-posted at Asymptosis.

Right, Steve. The reason the R’s say we can’t afford SS is because they hate it. Just purely hate it. Any country that can virtually exempt its billionaires and millionaires from taxation to the degree we do can afford anything it wants. Want money to run the government? Go where the money is. Want to control health care costs? Don’t give the job of setting prices to the insurers and providers. Duh. NancyO

Since income taxes aren’t paid by nearly half of Americans, the tax burden on those who are paying is necessarily twice as high. So, if the tax burden in total is 28%, doesn’t the tax burden on those who actually pay have to be closer to 60%? Of course we have to adjust for payroll taxes, which may bring the income tax burden on those who pay down closer to 40% or something…but your number acts as if the tax rate compared to GDP actually tells us something about the burden the income tax places on the middle and upper classes, when it obviously doesn’t.

SourMash:

Ah, the usual response… citing income taxes and ignoring all other taxes. How about looking at who has gotten all the income gains in the last 20 years before you say that? It’s called an ‘income tax’ so when the middle and lower classes go nowhere income wise then this is where you end up. Add to that dramatic increase in the percentage of people who owe no taxes from its historic norms to nearly half of all filers was primarily the result of the Bush tax cuts – perhaps you forgot to mention that. And Romney paid, what 13.9% on his millions – so that’s OK?

Well, don’t forget the tax differentiation between taxes on earned income, ordinary unearned income such as interest, and cap gains. Or, just plain tax exemptions. You can hold a billion dollars worth of equities, and pay no cap gain tax unless you sell them. And, if you get to write the rules about how and when you’re taxed, well, you’ll certainly go easy on yourself. And, forget FICA. Capital gains is the way to go. Oh, almost forgot. It doesn’t say much for this country when something like 40% of its citizens are too poor to pay income taxes. Think about it. NancyO

SourMash: “Since income taxes aren’t paid by nearly half of Americans”

Take a look at total taxation, not just income tax, or federal tax. The U.S. tax regime is basically non-progressive above about $60K or $80K a year in income. People at that level pay the same amount as people making $600K.

http://graphics8.nytimes.com/images/2009/04/13/business/economy/shares.jpg

On federal taxes, including both payroll and corporate taxes with a calculation of incidence:

http://graphics8.nytimes.com/images/2012/01/19/opinion/011912krugman1/011912krugman1-blog480.jpg

Sour Mash

one should not reason on the basis of pure ignorance. the tax burden on the hiighest earners is about 17% for “low high earners” up to about 25% for high high earners… and that is only on “taxable income.” i don’t know what their untaxable income looks like.

as for the bottom half that doesn’t pay taxes, i can only imagine they are living in the street, because i pay income taxes and i earn about as little as it is possible to earn without living in the street… and i own my own home so my “rent” is actually pretty cheap…. though it is, of course, another tax.

and no, the payroll tax is not a tax. and if you don’t understand that you “have nothing useful to say about our fiscal future.”

Steve

look at those CBO options again. note that raising the payroll tax one tenth of one percent per year would delive “0.6% of GDP” and that would be paid by the people who are going to get the benefit, avoiding turning Social Security into welfare as we knew it.

If you don’t understand that you have nothing useful to say about our fiscal future.

no doubt your sense of cosmic justice requires you to tax the rich man to pay for the workers’ retirement. mine doesn’t.

Steve: “U.S. providers charge two to five times what they charge in other countries . . . .”

I’m aware of one example: MRI machines are sold in Japan for half the US price. http://www.npr.org/templates/story/story.php?storyId=120545569 Surely, that’s because the prices of procedures are so much lower in Japan that an MRI machine would not pay for itself at the US price.

I think this is a very useful inquiry. Can somebody direct us to a long compilation of such discrepancies?

All our heathcare costs are somebody’s revenues. Whether we reduce the per-procedure cost by 20% or reduce the number of procedures by 20%, the revenue effect is the same and the resistance also the same.

Steve small technical correction.

It is true that Social Security brought in more income than it spent every year since the 1983 Act (normally shorthanded ‘the Greenspan Commission’) but that was NOT true for the years before that, in fact Social Security was cash flow negative more years than not between 1956.

This was by design and is an artifact of the fact that Social Security’s reserves, aka the Trust Funds, while not in principle an investment fund as such, do earn interest. In fact as SS Chief Actuary pointed out in an important article in the 75th Anniversary edition of the Social Security Bulletin a perfectly balanced Social Security system, one where TOTAL income covers TOTAL cost AND augments its reserve sufficiently to maintain a full one year reserve (the Trustees’ measure of ‘solvency’) it would be cash flow negative EVERY YEAR. Now in total numeric context this is a minor effect, the transfer amounting to maybe 2-3% of cost, and actually amounting to a discount from the nominal 5% being earned by that worker financed 1 year reserve, but the transfer is a feature and not a bug, the alternative being an interest free loan from workers to the General Fund.

Admittedly this result is counterintuitive, but that is true about much of Social Security finance and budgeting when examined at the granular level. And by the way this transfer would exist whether you adopt CBOs Option 2 (of which the Coberly-Webb-Larson NW Plan is a variant) or the cap increase of Option 4.

Social Security was and is carefully designed to be what I called in a 2005 post a Goldilocks program, neither too hot nor too cold. In fact a permanently cash flow positive Social Security system is in the long range more a danger than one in small deficit-the subject of another post from 2005 titled ‘Interest on Interest:a Threat’. It turns out you actually can be too rich.

But the important takeaway is that we can ‘fix’ Social Security in the way that will meet Steve Goss’s test for ‘Sustainable Solvency’ but surpluses will not and in the bigger picture SHOULD NOT return under foreseeable future economies. Social Security does not and need not function like a state or private pension plan. Just as federal budget accounting does not function in the same way that state and household budgeting do.

Given that cash surpluses will probably never return, at best for a couple of years before 2017, it is mildly dangerous to claim that this was typical for the system since inception. Because an examination of the historical data tables show that it just wasn’t true. Feature not bug of a well designed equitable pay-go system.

Para 2 should read ‘between 1956 and 1982’

Bruce

you seem to believe that income from interest is not income.

you seem to believe that income from interest is not income.

That’s the thing about social security — it’s not really an investment fund with external taps, unlike say Norway’s Pension Fund with its $100,000 per-capita investments in equity and bonds (hopefully not too much of the latter 🙂

If taxpayers have to pay the interest SSA receives, it’s literally taking money from one pocket to the other, or like taking more money from Jr now to pay for Sr’s over-contributions, 1990-2009.

The only grossly fair way redeeming SSA’s $2.5T in accumulated FICA and interest is to tax the income that is ABOVE the FICA cap.

(I generally agree with you that wage earners should fund their own retirements via FICA and that SSA should not be a transfer program. However, FICA payers subsidized the non-FICA payers with $1T+ of cold-hard cash 1990-2009 and it’s getting time that money is returned to the FICA payers)

you seem to believe that income from interest is not income.

Also, Congress has just been printing new bonds to “pay” SSA’ “interest income” thus far.

For 2009, SSA took in $667B in contributions and paid out $685B.

For 2010, SSA took in $637B in contributions and paid out $712B.

2011 will be affected by the 2% payroll tax cut, which will be a $100B/yr hit to contributions that Congress will just print new bonds to back-fill.

Can somebody direct us to a long compilation of such discrepancies?

http://www.kff.org/insurance/snapshot/OECD042111.cfm

And if you really want to crunch the numbers:

http://www.oecd.org/document/16/0,3343,en_2649_34631_2085200_1_1_1_1,00.html

Troy

I actually agree with you mostly. As it happens the Trust Fund will be paid by taxes collected on mostly the above the cap income. The only reason I only agree mostly is that the below the cap earners who will be paying back part of the Trust Fund got the benefit of the money “they” borrowed and there is no reason they shouldn’t pay interest on it, as well as pay it back of course. And at the end of the day the folks paying it back will not be the same people who lent it. Different generation as well as different income class. That borrowing from one pocket stuff is a cartoon to wow the rubes. The government borrows and lends all the time, just like a business, there are reasons for it that make perfect sense. Up to a point.

Meanwhile the money the Boomers lent to the government IS being repaid as we speak.That’s the “negative cash flow” everyone is so hysterical about. It was always part of the plan.

TRoy

all of which is true, but doesn’t mean anything evil. Trust me. it’s ordinary banking. The government is borrowing more to pay back what it borrowed before. Up to a point that is legitimate. We may pass that point, but that has nothing to do with Social Security.

Except for the payroll tax cut: that is a knife in the dark. It is intended to destroy SS. In fact it already has in the sense that SS is no longer the workers paying for their own retirement, but “the government” paying for the workers retirement by deficit spending… exactly what Peterson always said it was. Peterson was lying, but Obama has made an honest man of him.

Troy

true enough. but not evil as you seem to think. it’s ordinary banking. anyone can borrow from Peter to pay back Paul. Up to a point. We may pass that point. But it’s not Paul’s (SS) fault.

The payroll tax cut on the other hand is evil. It changes SS from workers paying for their own retirement to “the government” paying for the workers retirement by borrowing… exactly what Peterson always said it was. Peterson was lying but Obama has made an honest man of him.

well, the way things are going they will probably have FICA payer’s kids pay back the FICA surplus that was accumulated 1990-2009 via “broadening the base”, instead of increasing taxation on the top decile’s income that largely escapes FICA altogether like they should.

And/or scale back benefits via “chained CPI “to avoid having to pay back the surplus by screwing payees going forward.

If they just raise income taxes on the 99% to pay the FICA surplus back, the whole thing will have been a rip-off. A clever one, but a rip-off nonetheless.

as for SS not being an “investment” actually it is. Maybe Norway had a greater need to put the money into some industries, or maybe they just don’t understand pay as you go financing. Pay as you go automatically solves the inflation problem and provides a Real interest that is “competitive” with any private real interest at the same level of risk. the people who “invest” in SS get back the “time value of their money,” and the people “paying” the interest get back the time value of their money in turn. it is rather neat. i didn’t think it was hard to understand, but i didn’t read all the lies about it first.

as for interest on interest

there is nothing pernicious about this.

if i borrow a hundred bucks from you at 5%, i can come back at the end of the year and pay you $105. Then go out and borrow $105 dollars from someone else. Or I can come back to you at the end of the year and say… lets roll this over for another year. I end up paying “interest on interest” but I don’t pay any more than in the first scenario.

The only danger with interest on interest, also known as compound interest by the people who count on it, is that it can grow geometrically beyond your ability to repay… same as if you kept on borrowing larger and larger amounts (also known as “kiting” by the people who count on it).

The only danger of the SS debt growing out of control like that would have come from the “low cost” projection of the Trustees.

The “northwest plan” solved that problem at the same time it solved the opposite problem… SS taking in less money (including interest) than it needed to pay out. By adjusting the tax rate from time to time as needed, there is no need for SS to collect more money than it needs “forcing” the government to borrow more than it can afford. some readers will need to have that last sentence explained to them. thirty years of clever lying has made it almost impossible for them to understand the concept.

with SS paying benefits pay as you go with a one year reserve “in the bank,” the interest from the reserve will in fact come from the general fund and it will save the payroll taxpayers a small amount. but it will not grow out of hand and at the end of the day the government will have “lent” SS what is almost a static amount in %ofgovernment income terms, and if it ends up paying interest “forever” on that amount… not increasing because SS actually uses the interest to pay its bills, so the interest does not compound… the government could always just pay back the principle if it got tired of paying the interest. of course most likely it would just have to borrow the money from someone else, resulting in no net savings to the general fund. and SS would have to look for someone else to lend the TF funds to. just like you and me and the bank and the business on the corner.

moral: there is nothing funny going on here. it’s all normal business. it’s just the paid hysteria that makes it seem different.

troy

no. you don’t want the top decile paying for your SS benefits. that is the dole. most people with any self respect don’t want to live on the dole. those workers of the future can either get by on the SS benefits as currently scheduled (projected, not “promised”) or they can keep up with their own standard of living by raising their payroll tax one half of one tenth of one percent per year. that’s forty cents per week in today’s terms. pretty cheap price to stay off welfare.

i actually hate talking about this anymore. people don’t understand it. apparently CAN’T understand it and end up talking in half assed “moral” terms that don’t have a thing to do with any reality except that in their own internal set of “justice due me” accounts.

Nancy

actually,it’s “Wrong, Steve.”

The surplus from SS is not surplus to the federal budget. SS was created off budget for a good reason. The workers are paying for their own retirement. The government is not. The workers LEND the SS surplus to the government until they need it back. This makes the surplus SS a DEBT that the government owes. Which is what you might expect since the government runs a perpetual deficit and borrows money from Peter, Paul, SS, and the People’s Republic of China.

w

Thanks, Troy.

My first crunch of OECD data allows one to estimate how much revenue loss would be suffered by Pharma if US annual per-capita drug spending ($956.00) were in the middle of the pack like Netherlands ($472.50) or even at the level of second-place Canada ($743.70).

(Total 2009 expenditure on pharmaceuticals and other medical non-durables per capita, US$ purchasing power parity. Too many characters to post the whole table.)

according to statistical abstracts

federal individual income tax went from 16% of Adjusted Gross income in 2000 to 14% in 2006.

tax as a percent of AGI for workers making 1000 to 20,000 dollars per year averaged about 4 to 8 percent at each level (in other words folks who made les than 2000 per year paid 7% tax. so did folks who made 20,000 per year.

folks from 40k to 75 k paid about 10%

folks from 100 to 200 k paid about 17% in 2000, down to 13% in 2006

folks over 500k paid 28% in 2000 and 23% in 2006.

Source U.S. Internal Revenue Service, Statistics of INcome Bulletin.

now i don’t know, but if i had to guess i’d bet someone added up all the taxes paid by the bottom 47% of earners and subtracted all the benefits paid to “low income” people and came up with 0. and that’s as good as saying the 50 million of those people who paid 7% tax “paid zero.”

you see, it all has to do with Uncle Sam being one person, except of course when it’s convenient to divide us into the poor rich and the greedy poor.

The payroll tax cut on the other hand is evil.

Well, yes and no. It was stupid to put SS in the cross-hairs, but if one looks at it like a lower-bracket cut that was implemented via FICA then it’s not so bad.

But they really should have done just a lower-bracket cut instead.

you don’t want the top decile paying for your SS benefits. that is the dole

I didn’t say that. I want the top decile to pay back the $2.6T they owe FICA payers.

it is rather neat. i didn’t think it was hard to understand, but i didn’t read all the lies about it first.

I agree that SS is really elegant, but its very simplicity is difficult to analyze due to its uniqueness.

Also, there is something of a risk of running out of productivity gains to cover retirees, and also retirees on the whole outliving what they put in but still drawing for decades and decades.

Who knows, the top decile of the baby boom (aged 50 to 65 now) might live twice as long as actuarialy forecast, and their SSA checks, while not “redistributive” as the lower quintiles’ SSA checks are, are maxed out and could in fact prove to be an immense burden for Gens X and Y.

okay. glad to hear it.

Troy

you are just making up a folk song. the Actuaries have calculated that expected longevity and they are smart enough to know about the statistical tails, and it’s all factored into the “huge horrible hairy five trillion dollar unfunded deficit, gasp, that turns out to be a forty cents per week raise each year.

if we run out of productivity gains then the old folks will just have to collect their benefits in the coin of the time. we won’t be getting richer, but we will still be paying for our own old age by deferring part of our wages until we get old through the magic of pay as you go financing.

@Coberly: “The surplus from SS is not surplus to the federal budget. “

It’s a surplus to the Consolidated Budget. Pretending the Consolidated Budget doesn’t exist is just like pretending the Trust Fund doesn’t exist.

Coberly, you know I know how SS is funded. I don’t like raising the cap, but CBO’s #2 and #3 work better and preserve self-funding. Nevertheless, he is saying there is no problem paying for SS forever. I agree. NancyO

coberly: “The surplus from SS is not surplus to the federal budget.”

As Steve Roth points out, that depends upon what we mean by the federal budget. 🙂

coberly: “The workers LEND the SS surplus to the government until they need it back. This makes the surplus SS a DEBT that the government owes.”

Right. Which is why the loan has no net effect upon the deficit. It increases the deficit by the same amount that it decreases it. 🙂

coberly: “you don’t want the top decile paying for your SS benefits. that is the dole.”

No, you want them paying their fair share. That’s insurance. 🙂

you are just making up a folk song

In general, I think pension promises are going to be a big burden to everyone still working over the next 20-odd years.

The system has been able to avoid paying the piper on this since 1985 or whenever:

http://research.stlouisfed.org/fred2/graph/?g=4Eb

but the surplus is over, as each annual boomer cohort starts collecting their due pensions.

The bumrush into the workforce started in 1970:

http://research.stlouisfed.org/fred2/graph/?g=4Ed

and it’s this tail-end of the baby boom that numbers the most.

The top decile has had the easiest life on record and have access to the best medicine.

I think they’re going to be around for a while.

Not so sure about our economy, on the other hand.

Steve

no. but the Conslidated Budget (Unified Budget) doesn’t actually exist as a reporting tool for some purposes. The law is still that SS is not “on budget.” The reason it is not on budget is that it has its own funding source and its monies are protected from being used for “the budget” by the legal structure called the Social Security Trust Fund.

no. but the Conslidated Budget (Unified Budget) doesn’t actually existexcept as a reporting tool for some purposes. The law is still that SS is not “on budget.” The reason it is not on budget is that it has its own funding source and its monies are protected from being used for “the budget” by the legal structure called the Social Security Trust Fund.

Nancy

i know you know. Nevertheless he is saying that turning SS into welfare as we knew it is fine. I don’t agree.

What’s on your mind…

Min

that’s a pretty bizarre thing to say. When you borrow money from the bank does it increase you deficit (debt)? or does the loan decrease your deficit by the same amount it increases it?

as for “depends on what we mean by the federal budget,” i guess we can mean whatever we want to mean. but the reality is that SS is off budget, and that has legal consequences.

Min

They pay their fair share… about 12k a year for insurance. When you buy fire insurance, the insurance company charges you a premium based on the expected cost of the insured event, not on what they think would be “fair” for you to pay given your income.

Troy

this is more folk singing.

the Actuaries have taken into account reasonable predictions for the population demographics and life expectance, and the economy.. predicting a rather slow rate of growth.

it doesn’t help clear thinking if you just make stuff up out of dream fantasies based on something scary you read somewhere.

Troy

yes they should have done just a lower bracket cut. but they were evil so they cut the payroll tax instead.

I am very late to this discussion, but note that removing the cap may not solve the shortfall or make ss into a welfare program because if the high eaners pay in more traditionally social security has rewarded them by paying them out more. In other words, it really is not welfare because while there is redistribution from folks who die young-relatively-to those who live real long-on average people get back what they put in with interest. I think the Webb-coberly-whoever northwest plan makes some sense, but I have a plan of my own which calls for putting a tax on imports to level the playing field between different international corporate tax rates. I do not think that lower corporate taxes should be part of comparative advantage and the fact is that countries havce taken jobs from this country not because their citizens are willing to work for peanuts in conditions that are dangerous and unhealthy, but simply because U.S. companies can offshore income and avoid having it taxed at U.S. rates. I would put an end to that not by ;lowering U.S. corporate rates, but by taxing the imported goods when they come back to this country–iphones are an example. I would dump what we collect into the social security trust fund.

terry

i applaud your values. but once the rich start paying for Social Security they own it. and it won’t be long before they decide it is too generous, or it should only go to the “deserving” poor, or workers should work as long as they can before they collect, or…

and in any case most workers don’t want to be on the dole. they like the idea of paying their own way.

use your tax on imports to pay for the country’s needs. let the workers use SS as a vehicle for saving for their own retirements with their savings protected from inflation and market losses by pay as you go financing.

not all “transfers” are welfare. insurance is a transfer that is not welfare. it makes a big difference. and when it stops making a difference you won’t like what happens next. SS includes an insurance transfer built into the benefit schedule. high end workers get back more than low end workers in absolute money, but they get back less as a percentage “return on investment.” the difference is used to enhance the return to those who over a life time have not earned enough to save enough to be able to afford a basic retirement.

you are one of many well meaning people who want to find a way to tax the undeserving rich to help out the deserving poor. that’s fine, but don’t destroy Social Security to do it.

@ coberly

OK, let’s go back to square 1. The deficit is gov’t revenues minus gov’t spending. Social Security taxes are counted as part of gov’t revenues. Money in the Trust Fund used to buy treasuries are not counted as part of gov’t revenues. That would be double counting. Gov’t spending is what it is, regardless of whether money in the trust fund is used to buy treasuries or not. Since the trust fund buying treasuries does not affect either gov’t revenues or gov’t spending, it does not affect the deficit. 🙂

Ah! But it is better not to let people opt out in this type of insurance. Look. Suppose you have a cohort of 21 year olds and you say here is the deal: As a group you provide old age insurance for yourselves by pooling (and investing in treasuries) x% of your earnings. And the 21 year olds accept the deal. Then, 25 years later, a bunch of them want to opt out, because they have done well or are doing well. If they do, that queers the deal. You end up with low earners insuring themselves. The cap acts similarly. As insurance, that is inefficient. Saying that having no cap amounts to welfare is accepting their rhetoric.

If you have fire insurance, you are protected from a single event. Old age insurance is different. For most people old age insurance protects against a long series of events (or non-events). Since it occurs over time, you get information as you go along about who might need the insurance and who might not. You could structure the insurance to include that information. At one extreme, you would only get the poor insuring themselves, which would pretty much defeat the purpose of the insurance. At the other extreme, you do not let people opt out. Either way, you have a form of insurance, not welfare.

Troy: “I think they’re going to be around for a while.

“Not so sure about our economy, on the other hand.”

Sounds like you think that the plutocrats are going to screw us all.

it doesn’t help clear thinking if you just make stuff up out of dream fantasies based on something scary you read somewhere.

You’re just trying to shout me down now.

Believe it or not I think the SS public discourse is 99.9% bullshit designed to rip off the FICA surplus and move the program away from “socialism” to Wall Street’s tender embrace.

The right’s desire to kill it is orthogonal to how balanced it really is tho.

We don’t have good data on how long the baby boom is going to live since they are the first post-WW2 generation to hit 65. Life was generally very good for most of them, especially the more money they made while working.

Min

that is square one on an imaginary chess board.

first, SS is not part of “government revenues” except for certain reporting purposes. it gets confusing if you want to follow the “reporting”, but so far as i can tell the OMB counts SS as “revenue” for purposes of Unified Budget Reporting… which in fact means nothing as far as the law concerning the actual use of the SS tax is concerned… but it may make it easier for them to calculate the amount of money they “have to spend” without “borrowing from the public.”

All well and good, but the “revenue” they count by borrowing from SS has to be paid back to SS so it is part of the debt at the end of the day. that is both common sense and the law.

it is a capital mistake to reason in the absence of facts. (sherlock holmes, a fictional character, but maybe not as fictional as your understanding of SS.)

Min

you are a very funny guy and most of the time i agree with your values. but here you are just making things up and pretty much don’t know a damn thing about SS.

all of your story was considered by the people who designed SS. they made it mandatory, they limited the maximum “tax,” and the “insured event” while a little obscure amounts to “arriving at old age without enough savings to live without working.” That seems to happen to about 80% of the people. SS supplements their other savings making them a little better off than they likely would have been on their own, and provides basic support to those who would not have had enough for even a minimal retirement. all of this is made possible by the mandatory savings imposed on all workers, and kept from being welfare by restricting the maximum “tax” to what ends up as a reasonable insurance payment for those who did not end up with the fire.

this will not be clear, but i have tried and tried to make it clear and it has no effect. people are in love with their own little narratives. that’s why SS had to be made mandatory. it wouldn’t work if you left it up to the intelligence and prudence of the people. and it won’t work if you turn it into a “tax on the rich.”

Min

it’s a little hard to follow, but i think Troy is referring to the top decile of long livers in retirement. he does not understand that all that has been accounted for.

as for the economy, as long as it does not fall into real famine, there will always be enough for people to save about 10% of their weekly income against the day when they won’t have any income at all, and the best way for them to do this is by pay as you go which means their weekly savings (think the bread and meat they can’t eat this week) is used to feed those who are too old to work anymore. this is pay as you go and as long as each generation does the same thing, there is no difference between pay as you go and putting the money in the bank and hoping for economic growth to outrun inflation… except of course that with SS your savings are insured by the whole nation without regard to the state of the economy.

this is by the way the way people used to behave before capitalism was invented. worked for a million years or so. people were helped to remember the idea by folks who said to them “honor your mother and your father” and the occasional teacher who came along and reminded them that, yes, it was all about the money.

the plutocrats on the other hand

are out to screw us. maybe most of them don’t realize it. but they have beliefs, and even values that lead inevitably to the poor house for most workers.

they can’t stand the idea that “the help” would have any free time, or enough money to become financially independent of their benevolence.

coberly: “first, SS is not part of “government revenues” except for certain reporting purposes.”

So you are saying that Social Security taxes are not counted in figuring the deficit. How do you know? Where is that information? Thanks. 🙂

coberly: “All well and good, but the “revenue” they count by borrowing from SS has to be paid back to SS so it is part of the debt at the end of the day. that is both common sense and the law.”

Of course it has to be paid back. I never claimed otherwise. In fact, I have always answered the rhetoric about the “empty” Social Security Trust Fund by saying that the treasuries would be redeemed.

@ coberly

Raising the cap or eliminating it would not be a tax on the rich. It would simply be a different insurance structure. It does not change the basic picture, it simply adjusts it.

Coberly, I am not in favor of taxing the rich to help the poor. I distinctly suggested that raising the cap would not be a solution because if the rich pay more they will take more–at least that is the way social security has worked for 75 years. That is why I said your and Bruce’s plan had more merit, but politically it still runs into the buzz saw of more taxes on the little guys and the employers of the little guys and as the clown in the White House has shown, there is support for going the other way. That is why I am looking for another funding source which is really going to be American consumers who slop up cheap imported goods –think Walmart Nation–and the corporations which could produce the goods here at almost the same cost but want to save on taxes by producing outside the U.S. I figure that is not a transfer payment in any sense–either it is slightly more forced savings instead of blind consumption or it gets back a tiny bit of the taxes that the corporations are evading. Eventually, of course, I would hope it would keep a few more jobs here which is the ultimate problem with funding social security–keeping a large enough part of the population working for that “pay as you go” idea to work. We have dealt with the baby boom demographic issue, but only if the baby bust folks have jobs.

well, try page 123 or so of the OMB paper on budget concepts. it may take some finger counting to penetrate the mystery. if that won’t work for you, try noting that the law that set up the SSTF did so explicitly to keep SS money out of the hands of congressmen’s fungy fingers.

now, as for “counting,” that’s a different matter. they can account to their hearts content… for their own purposes… but that doesn’t change the law. the congress can change the law, but so far it hasn’t and i don’t think it will. there are easier ways to kill SS. the payroll tax holiday for instance.

No.

after forty years the richest workers will have paid about 480 thousand dollars into SS under the present law, present dollars. they will earn about 2% over inflation on that money. they will tell themselves they “could have” earned a lot more. they may be right… about half the time.

under your proposal, they will pay up to about twice that amount and there will be no way that represents a reasonable cost of “insurance” against the chance they might have ended up poor.

this is no more a “simple adjustment” than raising the speed limit to a hundred and fifty miles per hour is a simple adjustment in the traffic law.

Troy

no, trust me, I am not trying to shout you down. I am trying to call your attention to the fact… fact… that you are just making stuff up in your own head. not a terrible crime. it’s what most people do most of the time. but it is impossible for me to “explain” how SS works if you prefer your own folk stores to the actual facts.

we don’t have good data on life expectancy. the Trustees seem to think they can just project current trends out into the infinite horizon. i think there are natural limits to life expectancy. and some evidence is coming in that we may not even live as long as our parents on accounta some unhealthy developments in the way we live.

i prefer to ignore both my fantasies and yours and just run with the Trustees… because that is the basis for all the hysteria about SS. if we can show in their own terms, based on their own projections that the cost of the “huge shortfall” turns out to be 40 cents per week we might give the average citizen a basis to understand his choices.

meanwhile, suppose you are right and we will all live forever…. what do you propose to do about it today? i only suggest we take it one day… one year… at a time. we can adjust according to experience. there is nothing we can do to adjust for the infinite future until we get a little closer to living in it.

terry

i am all for your tax. but it becomes a transfer payment if you tax the rich to pay for the poor. that may be necessary at times for some people but it is not a good way for most people to spend up to a third of their lives.

i am aware of the “buzz saw of more taxes.” But forty cents per week? I think that most workers would eagerly pay that much to keep their SS just the way it is. But first they have to hear about it. And strangely enough neither the R’s or the D’s want to talk about that option. EVEN the CBO which printed that option managed to do it in a way that it takes pretty careful reading to realize that’s what they are saying.

oh, re the buzzsaw… what is your proposal but a tax? thing is the money starts out in someone’s pocket who has a reason to think of it as “his.” he won’t like giving it to the poor at the government gun. the poor guy may like giving it to himself in the form of a government managed, but not government paid, program that protects his savings and pays him enough interest to beat inflation, and insure him against personal bad luck.

Dale I neither said nor implied anything of the sort.

Steve phrased this in terms of cash flow, at least implicitly “always brought in more money than it spent”. It turns out this is not a true statement for the 1956 to 1982 period WHETHER OR NOT YOU INCLUDE INTEREST AS INCOME. In the event I chose to answer the claim in the sense that I felt Steve meant it which was cash flow. And much of interest income is not and will not be paid in “cash” as most people define the term, but instead in the form of Special Treasuries.

Perhaps Steve did not mean “cash flow” but instead “income” when speaking retroactively. If so his claim is still wrong. But assuming by “money” he meant cash extracted from the real economy, then even with a fix, whether Option 2 or 4, will never put Social Security in a cash flow positive position.

Which was my point, and it has little to nothing to do with defining interest as “income”.

Please refrain from claims about what I “seem” to mean, at least without citing the SPECIFIC LANGUAGE that leads you to believe that. Instead you are just trying to extract this from your interpretation of the meta of my comment. Well frankly your reading comprehension when it comes to my posts is not that good. Which may be the fault of my writing. in which case it would be a lot more civil to put your response in the form of a question as in “Did you mean X, because that is how it read to me” as opposed to the J’accuse implicit in “it seems” which too easily slides over into straw man argumentation.

And Troy that is not entirely true. Treasury started transferring cash to pay interest on the DI Trust Fund starting in 2005 and even transferred small amounts of cash to pay a small fraction of OAS interest in 2010. And it is quite possible that neither Trust Fund will ever return to a cash surplus, indeed DI is already redeeming its TF principal for cash.

BTW the best evidence that Special Treasuries are not Phony IOUs, those DI checks are still cashing.

Yes but the NW Plan is not enacted.

Plus the pernicious effects of interest on interest are not limited to Low Cost outcomes, you can get the same effect by slashing the benefit formula in the ways currently being proposed by the Right and certain Democratic Centrists. That is any solution that puts Social Security into permanent cash surplus risks triggering the interest on interest crisis.

I doubt the top decile or even the top decile of the top decile (I.e. the top 1%) are likely to live to double current projected average mortality. Do you really think the median is going to 162 years old? With half of that decile living even longer? Come on. Fun is fun but—

Bruce

as far as i can tell we agree on the facts. you seem to assume my tone is accusatory. no,my tone is declaratory.

we can always sort out confusion or even honest disagreement if we don’t start accusing each other of bad manners or imagining we are accused of bad faith.

there are bad faith contributers to the SS debate. you are not one of them.

sorry i don’t know how to talk like a diplomat. Heinlein had a funny take on that in one of his books… had a society in which the distinction between “protocol mode downard” and “protocol mode upward” was a matter of life and death.

relax.

yep. yep. and yep.

Do you really think the median is going to 162 years old?

Actually, I was thinking that the post-65 age might be twice the forecast.

In 1990, the last time the withholding was rejiggered, life expectancy at 65 was 15 years for men. Since 2000 it’s been rising at ~0.2 years per year!

Will the top decile of the tail end of the baby-boom (1957-63) live to 95 on average? Probably not. But our medical system is going to do all it can to make it so.

Troy

I should leave you and Bruce to fight this out. But both of you are not being careful enough with the way you are saying what you mean. It makes it hard to understand each other that way.

You said something about the “top decile” which i took to mean the 10% of retirees who live the longest. Bruce took this to mean something about “the median” which of course it did not.

even i can’t make out what “the post -65 age might be twice the forecast” means.

I think the last time “withholding” was rejiggered was 1983 but i might have missed something. i take by “withholding” you mean the payroll tax rate and not the amount of your income tax “withheld” from your paycheck.

life expectancy may be rising .2 years per year now (i don’t know) but it would be a serious mistake to project that rate out into the infinite future. i think the Trustees are expecting a life expectancy for men of about 20 years after age 65 in 2075 or so. Thats a total of 5 years over the 1990 number you cite, or about 5/75 or about .07 years per year. they may know more about life expectancy than i do, but i see no reason to either project this rate out forever, or to use another estimate just because we “feel” like it. we can make sense with each other if we all use the same numbers to start with. if we just want to make stuff up on our own intuition we can’t even start to make sense with each other.

@ coberly

Thanks. 🙂 I found the 2012 paper at http://www.whitehouse.gov/sites/default/files/omb/budget/fy2012/assets/concepts.pdf.

On p. 123, under Intergovernmental Transactions, i found this statement: “These transactions are exactly offsetting and do not affect the surplus or deficit.” That was what I said that seemed bizarre to you. The purchase of treasuries by the Trust Fund is an intergovernmental transaction, and does not affect the surplus or deficit. 🙂

I’ll have to agree that medicare will cripple the economy. Social Security and Medicare entitlements make up around 40% of the federal budget and there is no end in sight. The baby boomers that are beginning to retire now and will be retiring over the next decade are or so going to put a strain on Social Security and medicare. I personally believe that the United States government has set itself up for a financial collapse. While, I am not going to suggest such an event will happen tomorrow, we are certainly rapidly moving in that direction. Our national debt has increased 15 fold over the past 30 years and will continue to increase in the coming years…should we even survive that long. Of course this $15 trillion figure does not included currently unfunded future entitlement payments to the tune of $200 trillion. Clearly, this is a receipt for a financial disaster.

Dan Annweiler

CEO and Editor-in-Chief of Urban Survival Blog

Looks like my YouTube video suggestion didn’t post here is the link to it http://youtu.be/tXMIjaTGnWk

Min

we may be having a communication problem might even be my fault. it seems to me it is correct to say SS does not add to the deficit, and it does not add to the surplus. it is either incorrect or a “special usage” to count the money the budget borrows from SS as “revenue” and use that borrowing to reduce the deficit… not in the on-budget, but in the “unified budget” which doesn’t mean anything except as a reporting tool, or possibly a crib sheet for budgeteers who for their purposes can count on the SS surplus as “revenue.” or could when there was an SS surplus.

meanwhile the SS surplus which is lent TO the “on-budget” has to be paid back to the SSTF one day… and that day is now… at least in little bits and billions for the time being.

so it seems to me that it doesn’t make any sense to say “the transactions are offsetting and do not affect the surplus or deficit” unless you are very careful about exactly what you mean.

without making this any longer… there is “bookkeeping” and there is legal reality.

I’ll have to agree that medicare will cripple the economy. Social Security and Medicare entitlements currently make up around 40% of the federal budget. The baby boomers that are beginning to retire now and will be retiring over the next decade are or so going to put a strain on Social Security and medicare. I personally believe that the United States government has set itself up for a financial collapse. While, I am not going to suggest such an event will happen tomorrow, we are certainly rapidly moving in that direction. Our national debt has increased 15 fold over the past 30 years and will continue to increase in the coming years…should we even survive that long. Of course this $15 trillion figure does not included currently unfunded future entitlement payments to the tune of $200 trillion. Clearly, this is a recipe for a financial disaster.

Dan Annweiler

CEO and Editor-in-Chief of Urban Survival Blog

I’ll have to agree that medicare will cripple the economy. Social Security and Medicare entitlements currently make up around 40% of the federal budget. The baby boomers that are beginning to retire now and will be retiring over the next decade are or so going to put a strain on Social Security and medicare. I personally believe that the United States government has set itself up for a financial collapse. While, I am not going to suggest such an event will happen tomorrow, we are certainly rapidly moving in that direction. Our national debt has increased 15 fold over the past 30 years and will continue to increase in the coming years…should we even survive that long. Of course this $15 trillion figure does not included currently unfunded future entitlement payments to the tune of $200 trillion. Clearly, this is a recipe for a financial disaster.

Dan Annweiler

CEO and Editor-in-Chief of Urban Survival Blog

Looks like my YouTube video suggestion didn’t post here is the link to it http://youtu.be/tXMIjaTGnWk

if we just want to make stuff up on our own intuition we can’t even start to make sense with each other.

Sure we can. Some inteligences work better at an intuitive level, and reaiity is generally formed from many people getting together and sharing what their particular understanding of the elephant.

“The experts have got this under control” is not entirely reassuring to me.

kind of late in this thread to say it but here:

steve is “mostly” right about SS not being a contributor to the debt… it has always paid for itself. even in those years when it was “cash negative” it paid for itself out of the money it had saved from prior years in the Trust Fund, which is what the Trust Fund is for.

I find it very frustrating to be arguing with people who are essentially the good guys on SS. But their very good guy-ness leads them to want to go the next step and arrange for the rich to pay for Social Security. They don’t realize that that is fatal. SS was carefully designed NOT to be the rich paying for the poor. And there were good reasons for that, all “political” as even Roosevelt might say, but “political” is also very often “basic human psychology.” SS needs to remain “not the dole” not only to keep the rich from killing it as they kill all welfare programs, but because “the people” will not want to live on the dole for as much as a third of their lives. Welfare is a necessary thing from time to time and for some people with permanent disability. But it is not the way most people want to live their lives.

So, yea for Steve for pointing out that SS is in good shape, has always been in good shape, and can always be in good shape for a very low cost. That cost turns our to be a forty cents per week increase in the payroll tax each year while life expectancies are rising. A very cheap price to stay off welfare.

min

are you sure the quote you cite refers to SS? if you want to pursue this… and i think it would be worthwhile, i am trying to read the whole thing carefully to see if i can make sense out of it. i am sure it does make sense but not the way people “read” it… read it carefully and we can compare notes later.

Min

the whole paragraph from which you cite does not mention SS and appears to me to be not about SS at all. you can’t just assume that it is. it may turn out that it is, but i strongly suggest careful… careful… reading of the whole chapter at least.

coberly: “it seems to me it is correct to say SS does not add to the deficit, and it does not add to the surplus.”

Me, too. 🙂 It does seem that we have had a misunderstanding. Things happen. 🙂

@ coberly

p. 128: “Financing accounts also record intragovernmental transactions, such as the receipt of subsidy cost payments from program accounts, borrowing and repayments of Treasury debt to finance program activities, and interest paid to or received from the Treasury.”

That “borrowing and repayments of Treasury debt to finance program activities” is classified as intragovernmental transactions, as well as the interest. 🙂

@ coberly: “The Government’s debt (debt held by the public) is approximately the cumulative amount of borrowing to finance deficits, less repayments from sur- pluses, over the Nation’s history.”

Debt held by the public does not include the treasuries in the social security trust fund, and it represents cumulative borrowng to finance deficits, i. e., borrowing from the public, not from social security. 🙂

Also on p. 129: “In addition to selling debt to the public, the Treasury Department issues debt to Government accounts, pri- marily trust funds that are required by law to invest in Treasury securities. Issuing and redeeming this debt does not affect the means of financing, because these transac- tions occur between one Government account and another and thus do not raise or use any cash for the Government as a whole.”

That seems clear to me. 🙂

Min

it does not seem clear to me, because i have read parts you do not cite. The most important of which is the separation of SS from the budget.

and the “logical” fact that you can’t “borrow” money from SS without “owing” the money to SS… that is also a legal fact. That’s what the Trust Fund is all about.

I will eventually put together something that “clears this up” to the extent that OMB is not indulging in meaningless noises… which is not unusual among “experts.”

Troy

I couldn’t agree with you more about the experts.

But in talking about SS we need to start from some baseline or we just end up shouting at each other.

The default baseline is the Trustees Report… Intermediate Projection.

If you think things are going to be worse… you still have to say what you plan to do about it. If we all end up living a very very long time, some change in SS will probably be necessary. But I think we need to wait until we are a lot closer to that actually happening before we can decide what is reasonable to do. Just scaring ourselves silly about a possible future and then cutting our heads off (cutting SS) in order to save the cost of tomorrow’s dinner is not reasonable behavior.

Daniel

unfortunately you are the kind of scare ourselves silly and cut our heads off prognosticator i was talking about. The Trustees Report already accounts for reasonable projections of future costs to SS.. they can be covered with a tax increase of forty cents per week per year. Medicare costs… including the on-budget costs look like they would cost a similar amount… which is a much higher PERCENT of present cost, but not a higher amount of actual dollars.

the cost will not be BECAUSE of Medicare, but because of MEDICAL CARE. There is no way to avoid the costs without changing the way we do medicine in this country. But even if we cut the costs in half like the rest of the civilized world has done, it will still be a lot of money.

it turns out that even the rather meager growth projected by the Trustees suggests we will all have twice as much money AFTER paying for SS and Medicare as we have today, PLUS we will have paid for our retirement and our medical care in retirement. this is not a disaster or a burden.

what it may amount to is that we choose to pay a higher percent of our wages in order to live a longer and better life, and spend a lower percent of our wages on second trips to Las Vegas every year or a Mercedes AND a Ferrari in the Mcmegamansion garage.

the 200 trillion dollar unfunded future entitlements figure is bull shit. scare yourself to death if you want, but jeez, do it in the privacy of your own home.

I think it’s time to stop talking past each other as to whether you’re discussing the “On-Budget” budget or the Consolidated Budget. That’s pretty straightforward. The rhetorical and political implications are less so.

Steve

hang in there, if min wants to be part of this he can help me. i will try to sort this out, as i said. but so far it isn’t even clear that OMB is talking about SS in some of the paragraphs Min cites. And as far as I can tell the “consolidated budget” doesn’t actually mean anything except as a reporting tool or possibly as a crib sheet for some budget purposes where the origin, and debt-nature. of the “revenue” from SS does not need to be considered. also it would not be the first time an “official source” deliberately obfuscated the nature of SS.

@coberly: “the “consolidated budget” doesn’t actually mean anything except as a reporting tool”

*No* budget means anything except as a reporting tool. ??

Sort of like saying no map means anything except as a cartography tool. Well, yeah…

I’m thinking you understand quite quite clearly what the consolidated budget is, how it works. It’s not complicated.

If you eschew that (I hesitate to say: feigned?) confusion as a rhetorical tool, I think you’ll find that your comments become far less frequent, and far shorter.

@ coberly

Sorry, I have been rather busy lately.

The question of whether the Social Securty Trust Fund finances the deficit may be a technical one, but I think that it influences the political rhetoric. However, I am not sure that it does so in any essential way.

Some on the right have been scaring people with the claim that the Social Security Trust Fund is empty. That is absurd, because it contains treasuries. So they claim that the gov’t may not honor the treasuries. That is un-American.

Some on the left are claiming that Bush “stole” money from Social Security to finance the wars and are demanding that it be paid back. That is also ridiculous.

Both sides are making the same error, however, that money paid into the Social Securty Trust Fund should just sit there. Of course it should be invested in safe investments.

IMO, the idea that the Trust Fund is empty is a greater threat to Social Security than the idea that the funds were unjustly taken. The anti-war people should not make the claim that Social Security helped pay for the wars. It is not in general a good idea to adopt the assumptions of your opponents.

Troy:

“SSA should not be a transfer program”

All insurance is a transfer program.

Troy:

“Also, Congress has just been printing new bonds to “pay” SSA’ “interest income” thus far.”

Do you think that the Trust Fund should just contain cash?

Daniel Annweiler:

“I’ll have to agree that medicare will cripple the economy.”

Medical costs may cripple the economy. But not medicare per se. Medicare does a better job than private insurance. We do need to focus on the real problem of medical costs that increase faster than GDP. That has been happening since 1980, with the exception of the Clinton years. Let’s focus on the real problem: What have we been doing since then that has caused those spiraling costs?